Mike

Installeer de app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Opmerking: This feature may not be available in some browsers.

Je gebruikt een verouderde webbrowser. Het kan mogelijk deze of andere websites niet correct weergeven.

Het is raadzaam om je webbrowser te upgraden of een browser zoals Microsoft Edge of Google Chrome te gebruiken.

Het is raadzaam om je webbrowser te upgraden of een browser zoals Microsoft Edge of Google Chrome te gebruiken.

(financiële) toestand in de wereld

- Onderwerp starter corneliahz

- Startdatum

Angelface

Well-known member

Met je nieuwe pinpas kun je ook online betalen

Alle Nederlandse pinpassen worden vervangen. Sommige banken doen dat in één keer, andere banken nemen er jaren de tijd voor. Maar de passen van V PAY en Maestro die we sinds jaar en dag op zak hebben, verdwijnen hoe dan ook.

Alle Nederlandse pinpassen worden vervangen. Sommige banken doen dat in één keer, andere banken nemen er jaren de tijd voor. Maar de passen van V PAY en Maestro die we sinds jaar en dag op zak hebben, verdwijnen hoe dan ook.

Mike

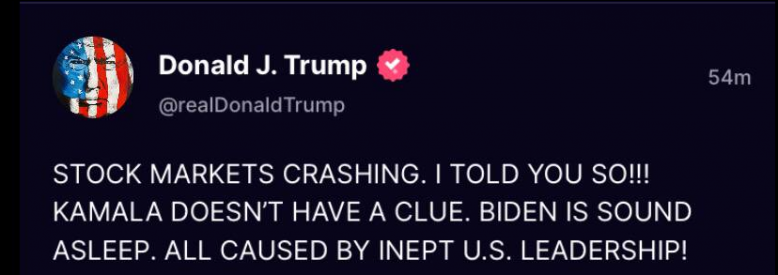

A wave of financial collapses in multiple markets is happening across the world.

Black Swan or Black Monday?

Stocks and crypto have plunged as investors start to panic while a global sell-off deepens.

Absolute chaos in Japan as stocks are on track for their biggest decline in more than eight years, following a significant drop last Friday.

This is an even larger drop than the Black Monday crash of 1987.

South Korea has halted all sell orders as markets crash more than 5%.

In the United States, the Magnificent 7 stocks have erased nearly $500 billion overnight.

With rumors of World War III and civil war across Europe, the markets are expecting an even deeper crash tomorrow.

Mike

Black Swan or Black Monday?

Stocks and crypto have plunged as investors start to panic while a global sell-off deepens.

Absolute chaos in Japan as stocks are on track for their biggest decline in more than eight years, following a significant drop last Friday.

This is an even larger drop than the Black Monday crash of 1987.

South Korea has halted all sell orders as markets crash more than 5%.

In the United States, the Magnificent 7 stocks have erased nearly $500 billion overnight.

With rumors of World War III and civil war across Europe, the markets are expecting an even deeper crash tomorrow.

Mike

Medusa

Well-known member

Donald J. Trump (@realDonaldTrump)

STOCK MARKETS CRASHING. I TOLD YOU SO!!! KAMALA DOESN’T HAVE A CLUE. BIDEN IS SOUND ASLEEP. ALL CAUSED BY INEPT U.S. LEADERSHIP!

Mike

THE STOCK MARKETS ARE CRASHING!!!

Japanese Stock Exchange Nikkei 225 just dropped by a staggering 6%. The largest 2-day drop in their HISTORY, and the largest drop in over 8 years. This is even a larger drop than the infamous “Black Monday” crash of 1987.

Asian markets across the board are starting to crash, as well as crypto markets, and futures are also looking scary.

The US magnificent 7 stocks erased over $500B of market cap in overnight trading, and over $2.9 TRILLION has been wiped from major indices and stocks because of fears of a looming global recession. BIGGEST DROP SINCE COVID IN 2020.

This looks to be the beginnings of a possible GLOBAL CRASH.

All of this comes as the England slips into Civil War, Biden is no where to be found, and Iran is getting ready to attack Israel.

It seems like they are going for broke BEFORE the election. This crash will be worse than 2008, and possibly than the Great Depression.

This is NOT A DRILL.

BUCKLE UP, PREPARE & PRAY!

As expected, we wake up to a MASSIVE Global Market Selloff!

The @Nasdaq, which represents mostly tech stocks is down +1000 POINTS today.

That is the MOST the NASDAQ has EVER been down not even on intraday.

That translates to $2 TRILLION that has been completely WIPED out of the US stock market this morning alone.

This week, over $3.8 TRILLION has been wiped from the stock market and crypto markets.

Right now, there is still activity and institutional traders buying volume, that is what is keeping the market afloat right now.

The 2008 crash started off in an eerily similar fashion, and got progressively worse each day…

BUCKLE UP.

#KamalaCrash

Mike

Japanese Stock Exchange Nikkei 225 just dropped by a staggering 6%. The largest 2-day drop in their HISTORY, and the largest drop in over 8 years. This is even a larger drop than the infamous “Black Monday” crash of 1987.

Asian markets across the board are starting to crash, as well as crypto markets, and futures are also looking scary.

The US magnificent 7 stocks erased over $500B of market cap in overnight trading, and over $2.9 TRILLION has been wiped from major indices and stocks because of fears of a looming global recession. BIGGEST DROP SINCE COVID IN 2020.

This looks to be the beginnings of a possible GLOBAL CRASH.

All of this comes as the England slips into Civil War, Biden is no where to be found, and Iran is getting ready to attack Israel.

It seems like they are going for broke BEFORE the election. This crash will be worse than 2008, and possibly than the Great Depression.

This is NOT A DRILL.

BUCKLE UP, PREPARE & PRAY!

As expected, we wake up to a MASSIVE Global Market Selloff!

The @Nasdaq, which represents mostly tech stocks is down +1000 POINTS today.

That is the MOST the NASDAQ has EVER been down not even on intraday.

That translates to $2 TRILLION that has been completely WIPED out of the US stock market this morning alone.

This week, over $3.8 TRILLION has been wiped from the stock market and crypto markets.

Right now, there is still activity and institutional traders buying volume, that is what is keeping the market afloat right now.

The 2008 crash started off in an eerily similar fashion, and got progressively worse each day…

BUCKLE UP.

#KamalaCrash

Mike

Angelface

Well-known member

Marktverkopers balen van pinkosten: 'Met telefoon kost tijd, betaal liever contant'

We pinnen steeds vaker en hebben dikwijls ook geen contant geld meer op zak. Pinnen is makkelijk voor de klant, maar ondernemers moeten 5 tot 25 cent per transactie aan hun bank betalen. Op de markt vragen steeds meer groenteboeren, kaasverkopers en bloementoko's hun klanten dan ook om met...

www.rtl.nl

www.rtl.nl

We pinnen steeds vaker en hebben dikwijls ook geen contant geld meer op zak. Pinnen is makkelijk voor de klant, maar ondernemers moeten 5 tot 25 cent per transactie aan hun bank betalen. Op de markt vragen steeds meer groenteboeren, kaasverkopers en bloementoko's hun klanten dan ook om met biljetten en munten te betalen.

Mike

Er was een bericht over de belastingdienst en het UWV.

Sommige mensen hadden te veel geld gekregen en sommigen te weinig. Het teveel hoefde Niet te worden terugbetaald.

Maar hoeveel mensen hebben te weinig gekregen en hoeveel te weinig?

Blijkbaar wisten ze aan de voorkant niet wat de achterkant deed.

Sommige mensen hadden te veel geld gekregen en sommigen te weinig. Het teveel hoefde Niet te worden terugbetaald.

Maar hoeveel mensen hebben te weinig gekregen en hoeveel te weinig?

Blijkbaar wisten ze aan de voorkant niet wat de achterkant deed.

Mike

Mike

Mike

Medusa

Well-known member

Kosten voor pinnen van contant geld fors hoger: dit zijn de nieuwe tarieven

"Volgens de banken is deze maatregel bedoeld om contant geld minder aantrekkelijk te maken en klanten te stimuleren vaker digitaal te betalen."

Het is de opmaat naar een totalitair regime met een sociaal-kredietsysteem en de banken maken deel uit van de invoering van deze duistere 2030

agenda van de VN/WEF/Club van Rome/Bilderberg.

Bron: https://www.nieuwspauze.nl/ (https://www.nieuwspauze.nl/kosten-v...-geld-fors-hoger-dit-zijn-de-nieuwe-tarieven/)

At minimal go fill up your car(s) because oil will hit $100 possibly $200 per barrel if Israel attacks Iran.

Their plans were already leaked. They are set on doing this.

It depends if Israel

1 attacks oil refineries

2 Iran closes the Strait of Hormuz

3 both

4 and this is the big one that was test shotted back in the Saudi Yemen war and that's Iran takes out the Northern oil fields in Saudi Arabia

Forcast had it above $80bbl the last quarter on 2024 even without a war

Mike

Their plans were already leaked. They are set on doing this.

It depends if Israel

1 attacks oil refineries

2 Iran closes the Strait of Hormuz

3 both

4 and this is the big one that was test shotted back in the Saudi Yemen war and that's Iran takes out the Northern oil fields in Saudi Arabia

Forcast had it above $80bbl the last quarter on 2024 even without a war

Mike

Forum statistieken