Installeer de app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Opmerking: This feature may not be available in some browsers.

Je gebruikt een verouderde webbrowser. Het kan mogelijk deze of andere websites niet correct weergeven.

Het is raadzaam om je webbrowser te upgraden of een browser zoals Microsoft Edge of Google Chrome te gebruiken.

Het is raadzaam om je webbrowser te upgraden of een browser zoals Microsoft Edge of Google Chrome te gebruiken.

(financiële) toestand in de wereld

- Onderwerp starter corneliahz

- Startdatum

The Fed knows something criticial here: fractional reserve banking is vulnerable. If a bank lends out 20-30X as much as it holds in demand deposits, it only takes 3-5% of depositors to panic withdraw to cause a bank crisis.

It's all about psychology, not about financial invincibility.

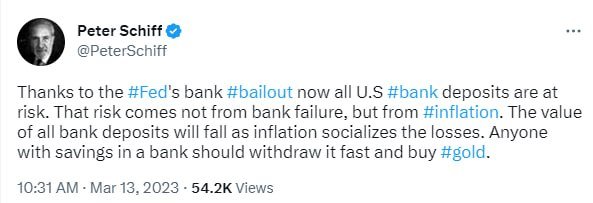

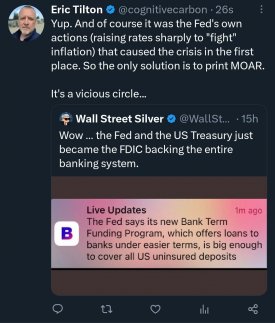

It was the Fed printing money (inflation) that caused the problem in the first place; that led to the Fed raising rates sharply to counter inflation (that it caused)...and now the solution is to print more money to bail about the banking system. Which is, of course, inflationary.

A vicious cycle.

CognitiveCarbon Public

The Fed knows something criticial here: fractional reserve banking is vulnerable. If a bank lends out 20-30X as much as it holds in demand deposits, it only takes 3-5% of depositors to panic withdraw to cause a bank crisis. It's all about psychology, not about financial invincibility. It was...

Mike

Mike

Mike

Mike

Mike

Mike

The Non-Bailout BAILOUT commences – total system collapse temporarily averted with emergency liquidity flood – NaturalNews.com

Three US banks collapsed last week (Silvergate, Silicon Valley Bank and Signature). Contagion took hold and quickly began to spread to other banks. The entire US banking system would have collapsed starting today if not for the FDIC jumping in and offering to rescue even non-insured depositors...

Mike

Mike

Forum statistieken